The Swedish Tonnage Tax System

The Swedish Tonnage Tax System

The tonnage tax system is a voluntary tax regime, applicable to companies carrying out qualifying shipping activities. Tonnage taxation is different from conventional taxation, as this tax is calculated based on the net tonnage of the ships, regardless of the company’s actual profit or loss. By offering qualifying activities tonnage taxation, the legislator’s goal is to make Sweden a more attractive maritime nation.

As the system is voluntary, companies that wish to be covered by the tonnage tax system have to apply to the Skatteverket (the Swedish Tax Agency). Once a company has entered into the tonnage tax system, the ability to withdraw is limited. To be eligible to the tonnage tax system, a number of criteria has to be fulfilled. The aim of this document is to present, from an overhead perspective, these conditions as well as highlighting other aspects that are specific for the tonnage tax system.

Who can apply for tonnage tax?

The Swedish tonnage tax system does not require the business to be organised in a specific corporate form. An application of tonnage tax should be submitted to the Skatteverket no later than five months before the start of the first fiscal year that the application concerns.

What kind of business operations are covered by the tonnage tax system?

Basically, all companies involved in maritime transport can use the system. In this case, maritime transport means the transportation of goods and passengers by sea. Operations that are necessary for, or closely linked to, such transports and which form a part of the payment for these transports, can also be eligible. Examples of such operations are the loading and unloading of goods in port areas, as well as transport of passengers in port areas.

In some cases, transportation services outside the port area can be covered by tonnage tax. In these cases, one condition is that the transport concerned is part of the payment for a maritime transport service, and also that the party buying the transport service has done so at market price. As an illustrative example might be mentioned a shipping company buying a transport service from a bus operator, in order to transport passengers to their ship or ferry.

Income derived from chartering out a ship might also be covered by tonnage taxation. Conditions differ, depending on whether it is a question of time charter or bareboat charter. In the case of time charter, it is sufficient that the ship is classified as a qualifying ship. In the case of bareboat charter, this requires, in addition to the fact that it must concern a qualifying ship, that bareboat charter is only made for three years during a ten year period, and also that rented tonnage represents only 20 per cent of the total gross tonnage for those qualifying ships that are part of the operations.

The tonnage tax system can also be applied to certain operations executed on-board qualifying ships. Examples of such operations are the renting out of premises, light entertainment that forms a part of the remuneration for the maritime transport and sale of goods for consumption on-board.

What is a qualifying ship?

A prerequisite for an operation to be regarded as qualified shipping activities, is that the transport in question are executed by a qualifying ship. A ship is classified as qualifying if the following conditions are fulfilled:

- the ship must have a gross tonnage of no less than 100;

- the ship must have its strategic and commercial management in Sweden; and

- the ship must serve mainly in international traffic, or on domestic transport in a foreign country.

Flag and ownership requirements

Also, in order for shipping activities to be classified as qualifying, the following conditions must, on a company level, be fulfilled for the qualifying ships that are part of the operations:

- no less than 20 per cent of the total gross tonnage refers to owned ships or ships chartered in on bareboat terms; and

- no less than 20 per cent of the total gross tonnage refers to ships registered in the EEA. Should less than 60 per cent of the total gross tonnage of the company’s qualifying ships refer to ships registered in the EEA, it is required, too, that the share of EEA flagged ships is either kept at the same level, or is increased during the fiscal year. If the company is part of the group the 60 per cent share may also be counted on a group level.

Group requirement

Should a company performing qualifying shipping activities apply for tonnage tax, and that company is part of a group, the other companies in the group carrying out qualifying shipping activities and which are subject to Swedish taxation, have to apply as well.

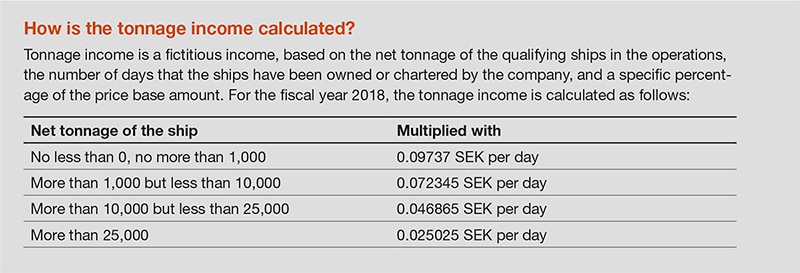

The income should be calculated for each ship in the operations, and the total income comprises the total tonnage income. From this income, no deductions are allowed. Thereafter, tonnage income is taxed at the applicable corporate income tax rate, currently 22 per cent.

Mixed operations

It is important to point out that the calculation of tonnage tax only applies to qualifying shipping activities. Should a company, in addition to its qualifying activities, also perform operations that does not qualify for tonnage taxation, these should be taxed in accordance with the conventional tax system. A company that carries out both qualifying and non-qualifying activities is considered to have mixed operations. In mixed operations, assets and liabilities should, as a basis, be booked in the line of business to which they belong.

Capital gains

Capital gains from the sale of a qualifying ship are covered by the tonnage tax system. If a sale results in a capital gain, this gain will, therefore, not increase the taxable income.

Accelerated tax depreciation

If a company, at the date of entering the tonnage tax system, has reported accelerated tax depreciation on tangible assets, e.g. on ships, that are to be subject to tonnage taxation, a so called differential amount should be calculated. The differential amount corresponds to the accelerated tax depreciation, i.e., the difference between the book value and the tax value of the tangible assets. This differential amounts is reported as revenue in the first year when tonnage taxation applies, but can at the same time also be deducted at the same amount, provided that a matching provision is booked to a so called accelerated depreciation fund in the accounts. Subsequently, the accelerated depreciation fund is reversed to taxation at a minimum of 25 per cent every five years, in case the company has not increased its tonnage to a certain degree. The process reminds of how you do with the Swedish tax allocation reserves (Sw. periodiseringsfond).

A company that has made a provision to an accelerated depreciation fund, will for tax purposes be required to report a standardized income that will be taxed yearly at the current corporate income tax rate. The standard income is 1.67 per cent of the value of the depreciation fund at the beginning of the fiscal year.

Period of suspension

Once the Skatteverket has approved an application for tonnage tax, there are limited possibilities to return to the conventional tax regime. If the company wishes to withdraw from the system, this can, as a main rule, only be done after ten fiscal years. After withdrawing from the tonnage tax system, there is a lock out period of ten years before it is possible to re-enter the system again. Early withdrawal might result in penalties.

Contact us